Outsourced KYC Partners

As a Partner user, you can create your customers in the Modulr Portal by adding all the necessary business information about the Customer.

As a regulated business, we need you to provide a few details about the business, structure and the individuals involved in the ownership ,to meet compliance requirements, in order to set up an account.

Go here for a detailed view of the information we require.

If you handle KYC yourself ('Outsourced KYC'), your Customers will be created on the Modulr platform immediately once you've added all the necessary business information.

Saving before submitting

You can save a part completed application and return to it later by selecting ‘Save & Exit’ in the application. Select ‘Applications’ on the Customers screen to go back to it.

1. Select Create Customer

Sign in to the Modulr Portal. You’ll land on the Customers screen.

- Select Create Customer

2. Complete the provisional customer form

Give us the Customer’s business name and acknowledge the disclaimers.

- Select Continue

Multi-entity Partners

If you are a partner who has signed contracts under both Modulr Finance Limited (MFSL - UK Entity) & Modulr Finance B.V. (MBFV - EEA Entity), you will see an additional field called 'Terms & Conditions'.

It is important you select the correct entity when creating new customers, if you are unsure, please contact your Customer Success Manager.

Once you’ve completed the provisional customer form, you’ll be directed to a page listing all your current applications.

- Select the new application from the list to start.

If the business is a Limited Company, Limited Partnership or a Limited Liability Partnership, our Business Lookup will pre-populate information so you don’t need to enter many details.

(Sole Traders and Ordinary Partnerships: skip to step 5)

- Select Limited Company, Limited Partnership or LLP

- Enter your business name in the search box

- Select your business when it appears in the list

- Select Continue

Important!

Make sure you select the correct business from the search results. The registered business number is also displayed so you can be sure.

If the business is a Sole Trader or Ordinary Partnership, we can’t retrieve your business information as it isn’t publicly listed.

When you start the application, you’ll be asked to fill in the details manually.

- Select Sole Trader or Ordinary Partnership

- Enter the business name in the field

- Select Continue

Our application form is broken down into different steps asking for business data and personal details of certain associated individuals related to the business that we must verify to complete your application - Information we ask for at signup →

- The progress of your application will be shown in the progress bar at the top left of your screen

- Once all required details are provided for each step, the ‘Next’ button will activate, allowing you to move to the following steps – you can go back at any time to edit previous steps.

- On occasion, our forms may ask for further information depending on what selections you are making, such as the ‘relationship to the business’ field when providing person details, please ensure all required fields are populated.

- Save or Send – before submitting – You can save a part completed application and return to it later by selecting the burger menu in the top right hand side, and selecting ‘Save & Exit’ in the application. Select ‘Applications’ on the Customers screen to go back to it. From this menu, you can also send the application to the Client to complete and submit (see step 9 below)

Information we ask for at signup →

7. Verifying the identities of People in the application

- For certain person tags i.e. UBO, we are required to verify the identity of these individuals before submitting your application.

- In these cases, you will notice when saving the details of some individuals, it will activate a ‘Verify ID” button on that person’s card.

- Select this button, and follow the instructions on screen – or you can follow this guide: https://knowledge.modulrfinance.com/knowledge-hub/id-verification-for-shareholders

8. Submitting the application

Once you’re happy all the information is correct, you can submit your application.

- Double check that all the information is correct.

- Read the disclaimer and select the checkbox if you agree with the statement.

- Select ‘Confirm and Submit all Information’.

Once submitted, you’ll return to the Customers list.

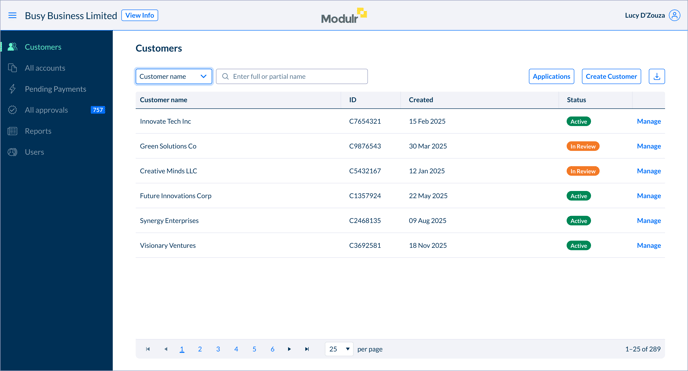

Customer Statuses

The Customer will be listed in the table, but may not yet be active depending on your setup:

Partner performs Customer checks

If CDD (Customer Due Diligence) checks had already been done on the Customer by yourselves, the Customer, and an account, will be created immediately.

Modulr performs Customer checks

If Modulr are handling the CDD checks, the Customer will become active once checks have been satisfied. You can see the status on the Customers page:

| Status | Description |

|---|---|

| In Review | The Customer is undergoing Modulr CDD checks |

| Active | The Customer has passed CDD checks and is active |

| Declined | The customer's application has been declined. Modulr's compliance team will be in touch. |

Viewing a non-active Customer's details

If a Customer is still In Progress, select the Customer row in the Customers page to view the Customer details.

Additional Information Requests

If Modulr are doing the CDD checks, and we need some additional information to support the application, we’ll be in touch via email. Look out for any emails from clientonboarding@modulrfinance.com (check your spam).